Seamless data integration

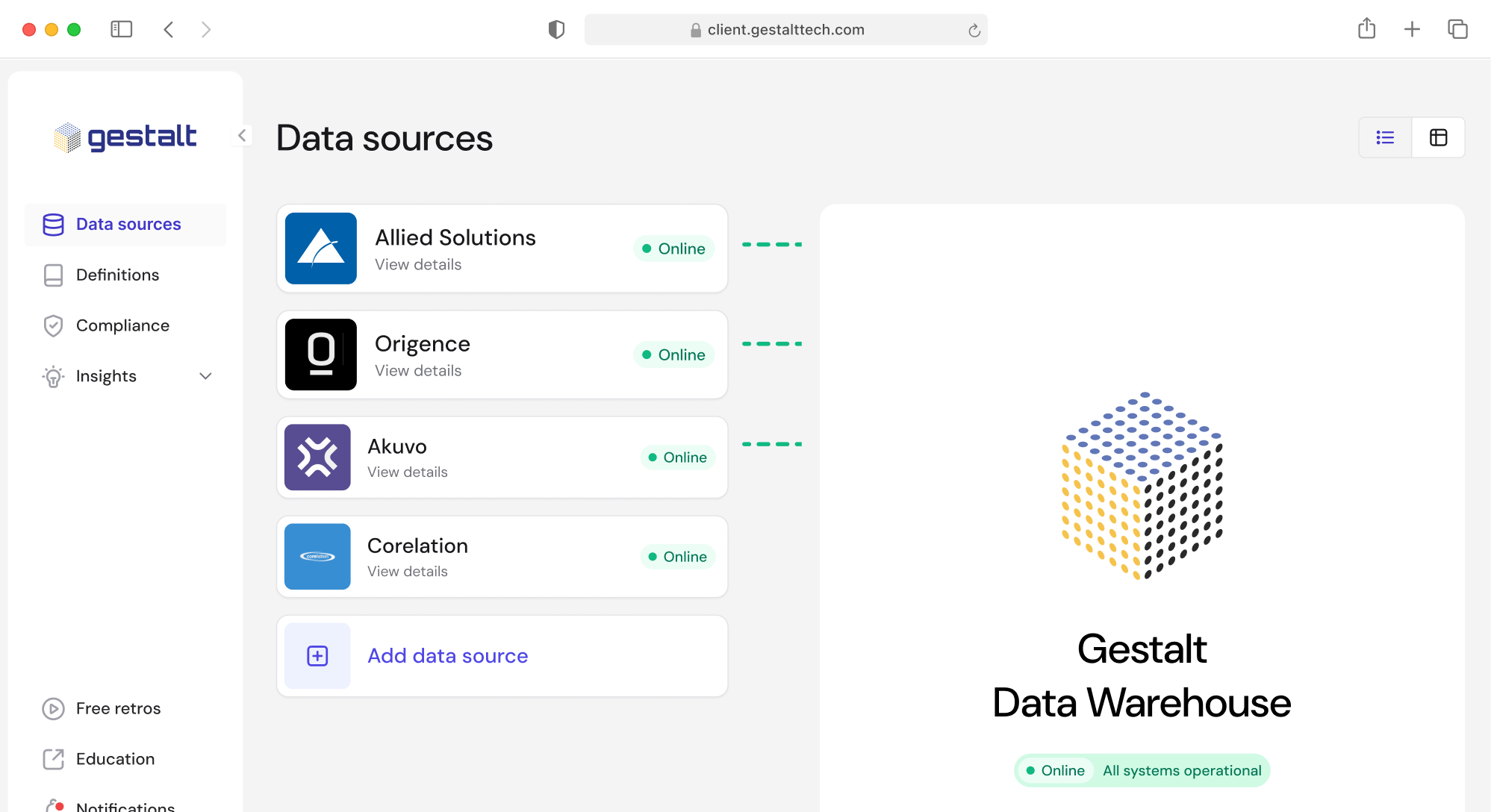

Gestalt pulls data from multiple systems—including Corelation, Origence, Akuvo, and Allied Solutions—into a single, structured foundation.

Eliminate silos and gain a transparent, structured data foundation—giving your credit union real-time access to insights that drive smarter decisions.

Many credit unions rely on legacy data warehouses and fragmented systems, making it difficult to manage and use data effectively.

❌ Siloed data – Key information is spread across multiple systems.

❌ Outdated Technology – Legacy warehouses lack flexibility and scalability.

❌ Compliance Burdens – Regulatory reporting requires clean, structured data.

❌ Limited Insights – Poor data structure makes strategic decision-making difficult.

Gestalt unifies all of your data into a transparent, well-structured foundation—ensuring real-time access, compliance, and powerful decision-making.

Gestalt pulls data from multiple systems—including Corelation, Origence, Akuvo, and Allied Solutions—into a single, structured foundation.

We clean, standardize, and organize your data to ensure accuracy and reliability.

A clear data model and comprehensive dictionary make your data easy to access and use.

Your data stays up-to-date with continuous syncing, governance, and automation, all managed through our scalable SaaS platform.

Gestalt isn’t just a data foundation—it’s a complete solution designed for credit unions. We provide tailored deliverables that simplify compliance, enhance insights, and drive better financial decisions.

Industry comparison using NCUA statistics

Pre-populated regulatory forms to simplify reporting

Easy data access for regulatory examinations

Insights and reporting into loan performance

Understanding usage of products like Allied Solutions' products

We’re more than just a data provider—we’re your partner. Gestalt is a Credit Union Service Organization (CUSO) committed to collaboration, transparency, and innovation to help credit unions maximize the value of their data.

Credit unions thrive on cooperation and shared insights—and we believe data solutions should be no different. As a CUSO, we work alongside credit unions to develop solutions that meet the industry’s real needs, ensuring that our data foundation is built for and with credit unions.

By joining forces, credit unions in our CUSO community can:

We don’t just store your data—we transform it into a powerful, structured foundation. Unlike traditional data warehouses, Gestalt is:

✅ Designed specifically for credit unions – We understand your core systems, compliance needs, and reporting challenges.

✅ Actively working with credit unions today – Our technology is already helping credit unions gain transparency and control over their data.

✅ A true partner, not just a vendor – We succeed when you succeed, and we’re committed to long-term collaboration.

With clean, structured, and easily accessible data, credit unions can:

Experience the power of a unified data foundation. Schedule a demo to see how Gestalt helps credit unions eliminate silos, simplify compliance, and unlock actionable insights.